Published: June 21, 2011

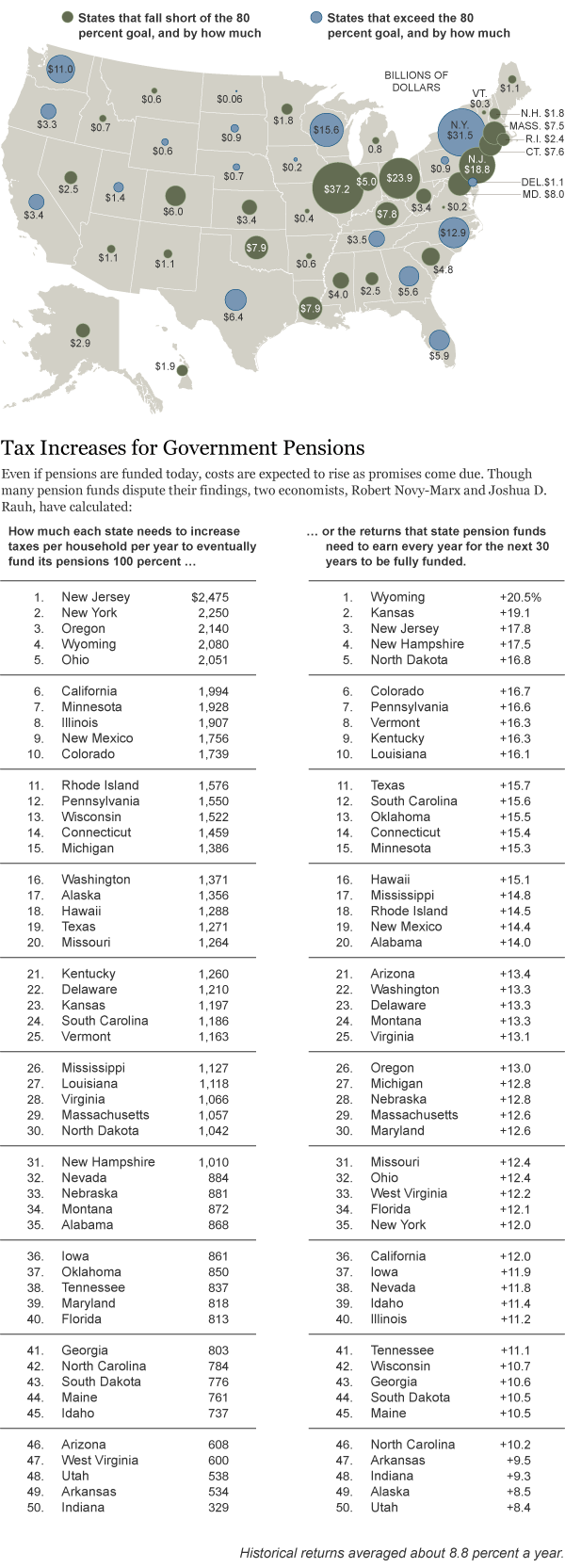

A $176 Billion Gap for Public Pensions

In general, many experts say pension

funds should hold 80 percent of the funds needed for future obligations. Many

states, however, have failed to put enough aside.

Note: The baseline uses estimated assets and liabilities as of

December 2010, assumes that public employees will continue to contribute to

plans at the rate they did in 2009, that states will continue to grow at rates

consistent with the last 10 years, and that plansf assets will, over time,

achieve investment returns equal to the long-term risk-free rate, or the rate of

return provided by long-term Treasury inflation-protected securities. For a

response to these figures from Nasra, the National Association of State

Retirement Administrators, click here.

By THE NEW YORK TIMES